Testing the generator and filling a few spare gas cans…

Those were the primary checks on my to-do list when I lived in south Louisiana and a hurricane was bearing down on the bayou.

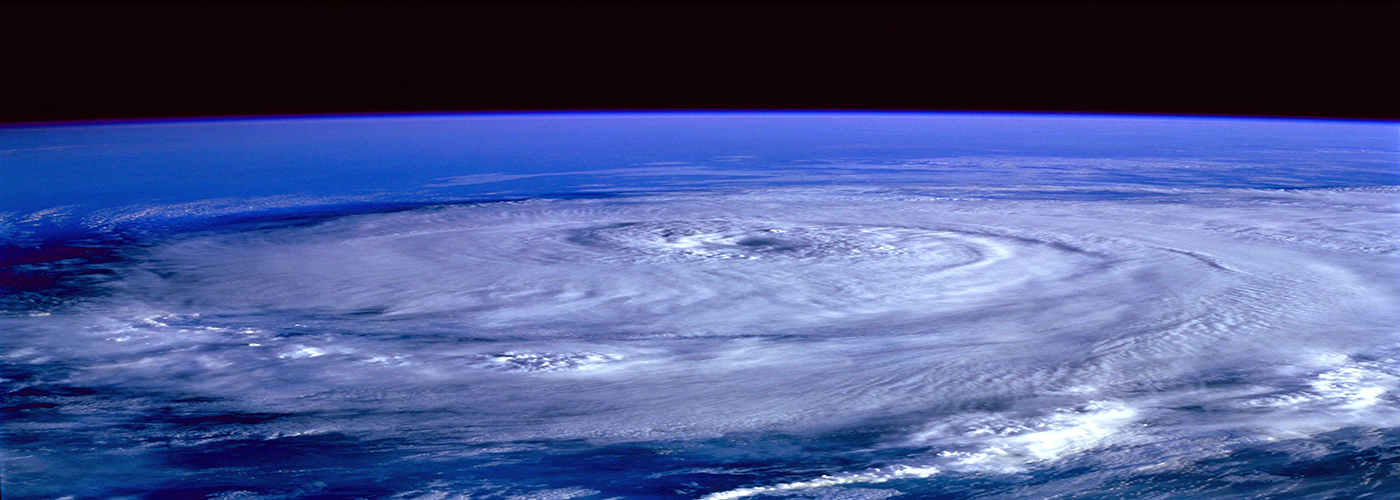

At the moment, there’s no ‘cane to worry about. At least not meteorological. There is, however, a potential financial storm a’brewing and it could very well blow up into an economic hurricane that spins through the markets.

On July 31, the federal eviction moratorium ended. Already, the evictions are beginning in some areas.

One of my son’s childhood friends now owns a boatload of rental properties in south Louisiana. He just delivered an eviction notice to a renter months and months and months behind in rent. He was met at the door with a shotgun.

What I’m saying is that it’s about to get ugggg-leee across the country over the next several months. Already the court systems are backing up, with eviction cases at pre-pandemic levels. The U.S. Census Bureau reports that an estimated 7.4 million renters are in arrears. The Center on Budget and Policy Priorities says the problem is bigger: 11.4 million tenants—16% of adults in rentals—are not caught up on rent.

Aspen Institute says, nope—it’s 15 million, and they owe a combined $20 billion.

Not all those people will end up on the eviction rolls. Some certainly won’t, at least for another couple of months, because Democrats in Congress pressured the Biden administration yesterday to extend the moratorium in COVID hot zones until Oct. 3. Still, when this all shakes out, there’ll likely be many millions of evictions.

And there’s going to be a rash of bankruptcies as landlords struggle to pay mortgages on properties for which rent has not been flowing in.

It’s all going to leave a mark.

But that’s just the storm.

Where we might just stumble into hurricane territory comes when the federal government’s various pandemic benefits end (currently slated for next month, but as with the evictions moratorium, that could change). Financial cold turkey is going to be painful for millions of American families from whom all the free government cash was a lifestyle preserver.

That will prompt many people to rush into a workforce that right now goes begging for workers.

Of course, many of those jobs are in the low-wage services industry, so they don’t do much to help people afford a middle-class life in high-cost America. Then again, even a low-wage income is better than nothing.

The problem, however, is that COVID’s alphabet soup of variants keep spreading and worsening and spinning out so many side effects.

Among these side effects: Unemployed parents can’t find adequate childcare in a COVID world, so that will hamper their ability to take on a job.

Other parents refuse to send their kids to school because certain states have adopted anti-mask mandates that put the health of kids at risk, which, again, impacts job searches.

And restaurants and other businesses where people congregate are noticing a fall off again in customer traffic, which could well lead to a new round of staff reductions, which throws us right back into a joblessness problem (and will likely necessitate government cranking open the dollar spigot once again).

Now, I’m not saying any of this will, in fact, stir up a hurricane. Just as in the weather world, storms regularly threaten to transform into ‘canes only to peter out into a few rain showers here and there. Maybe Delta and Lambda variants tire of tormenting us humans and they fade away. Maybe everyone who is evicted finds a place to live and the transition is smooth, like the moratorium never happened.

Maybe.

Then again, tropical storms sometimes blow up unexpectedly into meteorological monsters and wreak all sorts of damage over a wide area.

The impacts of the eviction moratorium and the end of the government’s COVID largesse will take a bit of time to filter through the economy. By early winter we should have a clear idea of how things are playing out.

Of course, we’ll likely see hints of the future in the behavior on Wall Street. If stocks start tanking and bond prices start rising, we’ll know the soothsayers on the Street are freaking out about a backsliding economy.

So, I remain content holding gold and silver, and an abundance of Swiss francs in my retirement account. I’m also content in my limited exposure to the U.S. stock market (primarily healthcare and consumer-vice stocks).

I guess you can call it the generator-and-gas-can portfolio.