Dear Field Notes reader,

I like charts.

They cut through and clarify. They distill sometimes ephemeral concepts into concrete images that immediately resonate. Better yet, they can lay to rest misguided notions of the past.

To wit…

Sorry, I was playing with colors today.

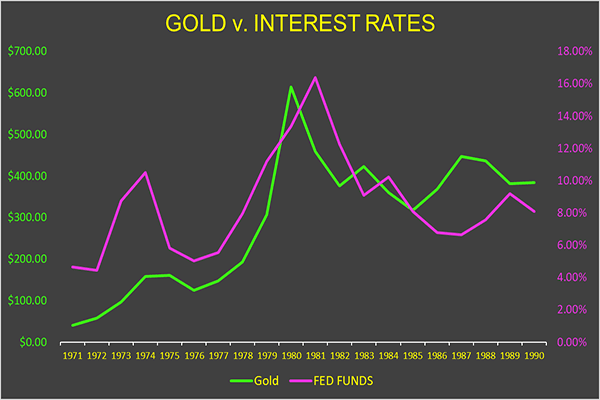

What you’re looking at is the refutation of a long-held belief that because gold pays no dividends or interest, the metal sinks in value when interest rates in the U.S. are high or rising. If that were true, then today would not be a good moment to hold gold.

See, inflation in the U.S. is on the cusp of a meaningful sprint higher, as I wrote to you in Thursday’s dispatch.

Bank of America is talking about a sea change in inflation after nearly four decades of tepid inflation. Jamie Dimon, Grand Pooh-Bah of the Moose Lodge better known as JPMorgan Chase, recently told Bloomberg TV that people are “starting to worry” about rates going up—i.e. inflation.

With all that—and more—unfolding right this very moment, gold should be weak in the knees.

If interest rates go up, yields on savings accounts and certificates of deposit go up. Yields on newly issued corporate and government bonds go up. The zero-point-nothing interest rate your cash is now earning climbs up off the floor and your money is earning a bit of interest income…

So, gold prices should retreat.

In theory.

Alas, my neon-addled chart above says, “Hey, wait a minute. Is that really true?”

No. It’s not.

The last time America battled an inflationary bugbear was the late ’70s, early ’80s. The Fed Funds rate (the rate the Federal Reserve pushes and pulls on to manipulate the economy) soared to more than 16% from just over 5%, in an almost perfectly straight line.

Double-digit CD rates? Surely no one would care about gold. It earns bupkis. Why hold a bupkis-earning asset when a simple bank deposit gives you a huge return?

Well, not so much really.

As the chart shows, gold almost perfectly shadowed that almost perfectly straight ascent in Fed Funds rates.

Why?

I suspect it’s the logic of economic fear. Inflation like we’re talking about is painful to the pocketbook. The average consumer doesn’t need to understand high-finance to know that. It’s a reflexive instinct born of simply pushing a shopping cart through Piggly Wiggly for the week’s vittles. You and I have whined a bit through the years simply because of the milquetoast inflation we’ve faced in the last three decades.

Cogitate on a world where we’re suddenly living that ’70s show again.

I honestly don’t think that’s out of the question.

The Biden administration is now rolling out the new $1.9 trillion stimulus plan. Toss that onto the heap of COVID spending D.C. has already completed and we’re talking about $4.8 trillion. Plus, Congress added on another $1.2 trillion in your run-of-the-mill pork-barrel spending when it approved the second COVID disbursement in December.

All in, then, D.C. has spent $6 trillion extra in the last year alone. The entire U.S. economy is $21 trillion. So, government has dumped into the economy a sum of money equal to near 30% of America’s entire annual economic output.

In the immortal words of Chris Farley’s title character in Tommy Boy, “That’s gonna leave a mark.”

Which is why I wanted you to see that chart.

Even though we are moving into an era of higher interest rates—and, thus, higher rates on bank accounts and bonds—gold isn’t likely to show much weakness. Consumers, investors, and savers are going to sense bad juju ahead. They will rightly worry about the U.S. dollar. And about the price tags in their daily life becoming more and more expensive.

And they will look for ways to preserve their spending power.

Gold’s sitting pretty in that world. Silver, too, but there’s a bigger story I want to tell you about silver at some point soon. (I suspect bitcoin will rally meaningfully, as well, but crypto has never faced an inflationary environment, so this should be interesting.)

Gold will sing the same song it sang 40 years ago. It will follow interest rates higher—a fear-for-my-wallet trade.

So, I go back to the recommendations I’ve been making for more than a decade now as gold has continually marched higher:

- Buy physical gold in the form of bullion bars in whatever size you can afford or gold sovereigns from Britain, Australia, Mexico, China, and Austria, among others; or collectible gold coins minted over the last couple of millennia. You can often find bullion coins from the past century trading at prices 5% to 10% above the underlying value of their gold, that’s not a bad price.

- Own a gold exchange-traded fund (ETF), but not just any ETF. Many of the biggest ones are essentially “paper gold.” They don’t give you direct ownership of the metal, just a claim on a piece of paper representing gold that might or might not actually exist inside a vault. Choose one that owns fully allocated metal that is never loaned out.

- Finally, look at mining stocks. They’re leveraged plays on gold prices. They produce oodles of gold annually, but their cost structure is largely fixed (aside from energy costs). As such, rising gold prices create windfall profits that drop almost unimpeded to the bottom line. That will lead to higher share prices and bigger dividend payments. You can find my specific recommendation for a mining ETF in the March issue of the Global Intelligence Letter.

This time around, the inflation will be real. Prepare while you can.