Higher Inflation Is Coming Next Year…

Jerome Powell, the Federal Reserve’s Grand Wizard of Backtrackery, had this to say during a virtual conference with the South African central bank a few days ago: There is a now a greater risk of “longer and more persistent bottlenecks and thus to higher inflation.”

Hmmm…

Never saw that coming, Jeff sarcastically thought to himself.

I hate to beat an inflationary horse when it has pulled up lame, but this was always going to be the case.

The Federal Reserve has never sported a solid record of economic management. That’s not me just spouting off. That’s statistical.

During the early part of the 2010s, the Heritage Foundation spent some time exploring America’s economy, pre- and post-Fed (for the record, the swamp creature that runs America’s money was birthed in 1913).

What Heritage found was this:

- Between 1790 and 1912 (pre-Fed), consumer prices inflated annually at a rate of 0.22%.

- Between 1913 and 2013 (the Fed years), consumer prices inflated annually at a rate of 3.35%. (Nothing much has changed in the last eight or nine years that would drastically alter that comparison).

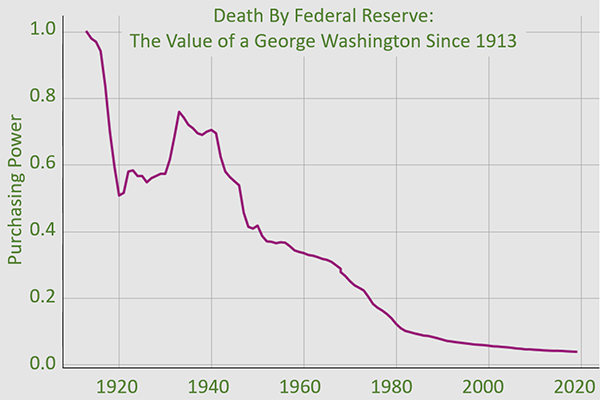

That last bullet point explains this infamous chart I am certain you have seen:

The nut of that chart is this: The $1 bill your grandfather or great-grandfather owned in 1913 is equal to four pennies today.

The Fed has done nothing to protect the dollar, and pretty much everything it can think of to destroy the dollar.

There is, of course, a madness behind the method.

The Fed needs to engineer an ever-weaker dollar to allow the American government to borrow heavily, then repay the excessive indebtedness with cheaper greenbacks.

That’s been the easy, aspirational way to spend America into economic primacy. Not at all unlike a family of four earning $50,000 a year pre-tax, yet zipping around that Walmart parking lot in an $84,000 Cadillac Escalade SUV that they’re leasing for nearly $1,000 a month.

Had Congress instead relied on tax income and whatnot to fund the government—you know, living within its means—America today would not be an anorexic chimp pretending it’s an 800-pound gorilla.

We’d be a smaller, yet substantially stronger economy, financially speaking…we’d be the Switzerland or Norway of the Americas. We’d be something like an orangutan—quiet, docile, yet powerfully strong when we need to be.

But that’s neither here nor there relative to this missive…

Back to the main point: When anyone at the Fed tells you “X,” you can pretty much bank on the fact that “X” is, in fact, not the right answer.

Transitory inflation was never the right answer. That was always going to be a fib.

Granted, it’s a fib the Fed had to tell.

Monetary monkeys cannot go around scaring the bejesus out of Wall Street and the bond market. Both of those in freefall would be bad news for the economy.

The Fed has to treat the financial markets like a petulant child. You don’t suddenly introduce new ideas or wholesale changes for fear of a meltdown. You ease into them. You lie. You coddle. You prevaricate. You gaslight.

Over time, you recalibrate the lies. You slowly bring truth into the equation so that when reality strikes, the market (petulant child) feels like it always expected this. All goes swimmingly.

Hopefully…

The only problem, of course, is that you’re still dealing with real reality, regardless of the thickness of the sugar-coating.

In our case, real reality means dealing with inflation now that’s well into the 5% range. That’s hurting wallets. Per a Reuters headline: “Inflation eroding households’ buying power.”

The pain’s going to increase before it subsides again, so get ready for that, because we’ll be dealing with even higher inflation next year.

How high?

Shoulder shrug.

I’m still saying we see at least 10% before the Fed gets inflation under control again. Might come in 2022. Maybe a bit later.

Whatever the case, though, the Fed’s gonna do something. Maybe it protects Wall Street and the bond market, which only exacerbates future pain. Or it will raise interest rates, sending Wall Street into a meltdown.

More on this soon—from Mr. Powell’s partner in crime at the Treasury Department…