You might recall that on Saturday, I wrote to you about Iron. Finance and how Mark Cuban and I got wrapped up in a crypto disaster last week. (If you missed that dispatch, you can read it here.) Ultimately, I recouped nearly $500 of my original $545 investment.

And you know what I did: I immediately reinvested that money in a different decentralized finance, or DeFi, project paying me an annual return of 204%.

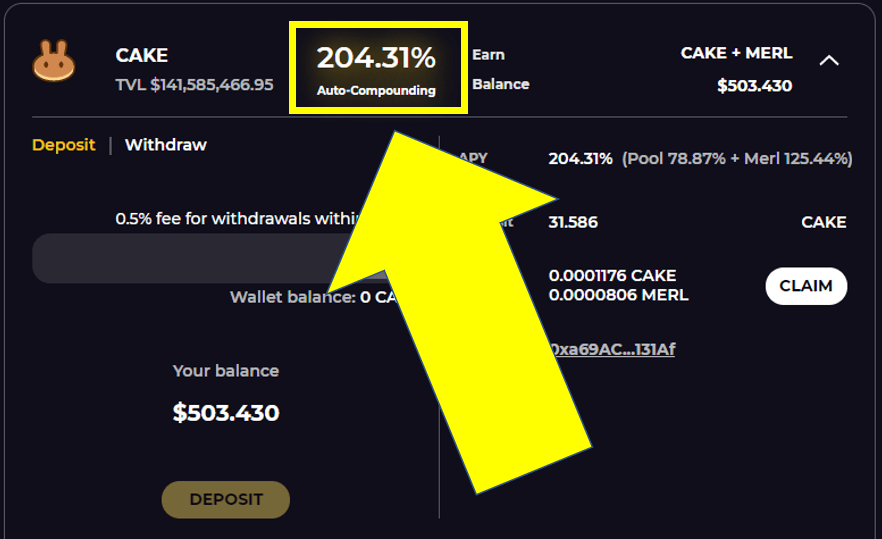

Here’s the screenshot…

I’m not letting a bad experience turn me away from DeFi and the cryptoconomy—one of the greatest wealth creation opportunities that has existed in my lifetime. Crypto right now is the rise of the internet in the 1990s…on an overdose of steroids. It will mint uncountable numbers of millionaires from people who put modest amounts of money at risk.

With today’s dispatch, I want to show you what one of those wealth-creation strategies looks like.

First, this is absolutely not a recommendation. You need a really high risk tolerance to operate in this space. Instead, this missive is purely educational—it’s simply to show you what’s out there in the Wild West of DeFi and the cryptoconomy, and to explain how some of this stuff works so that the insane rates of return make sense.

What I am doing here is something called “yield farming.” I’ll show you the process in action so you can see what’s going on and why…

What I’ve done is invested roughly $500 into a cryptocurrency called PancakeSwap (symbol: CAKE) at just under $16 each. Despite the whimsical name, CAKE serves a legit purpose in running the PancakeSwap website, which is one of the largest, most popular sites on the internet for trading directly between cryptocurrencies. Think of it like heading to your brokerage account and directly trading Microsoft stock for Apple without first having to sell Microsoft for cash before buying shares of Apple.

My roughly $500 bought me 31.586 CAKE tokens, which I have deposited into an “auto-compounding” program on another DeFi site called Merlin Lab. This site has been audited multiple times and holds more than $225 million in investor assets.

My CAKE tokens are part of a much larger pool of CAKE that surpasses $143 million on Merlin Lab. Through back-office algorithms and whatnot, that CAKE pool is “staked” on the PancakeSwap site, and the “interest payments” it earns are automatically reinvested in more CAKE.

In the cryptoconomy, staking is basically like sticking your money in a high-yield savings account. Except in crypto, the “interest” isn’t paid in dollars and cents, but in additional crypto tokens—sometimes that’s the same crypto you invested, sometimes it’s a different crypto, and sometimes it’s two or more crypto.

That’s what’s happening with my investment at Merlin Labs. I’m earning two different cryptos.

I’m earning a 78.87% return in additional CAKE tokens through Merlin Lab’s auto-compounding program on the PancakeSwap site.

I’m also earning 125.44% in Merlin tokens (MERL), which run the Merlin Lab site.

So, this means my total return is 204.31%.

The questions people always ask me are: Why does staking pay so much? How can these returns be real?

Consider this example: You take $5,000 out of the bank and shove it under your mattress. That money still exists, but it’s out of circulation—it doesn’t move through the economy.

If each of the 330 million Americans did the same, $1.6 trillion would be hidden under mattresses—just about the amount of physical cash that exists in the U.S.

There would be no physical dollars. The economy would grind to a halt. Banking would collapse.

It’s the same in crypto. If everyone who owns CAKE simply held onto those tokens, there would be no CAKE in circulation.

To incentivize investors to keep their CAKE in circulation, PancakeSwap pays rewards (think, interest) for staking CAKE on the PancakeSwap site. In a very real sense, then, my 31.586 CAKE are helping provide liquidity to the market for CAKE. It’s allowing other investors to trade between CAKE and numerous other coins.

Another way to understand this is to think about a currency exchange booth. Its sole purpose is to provide liquidity to dollar owners who need euro for their trip to Barcelona. For providing that liquidity, the exchange booth earns a fee from the transaction.

My fee is additional CAKE tokens that, through Merlin, are automatically reinvested, or re-staked. It’s identical to compound interest on your savings account at a bank—only much larger because of the size of the rewards earned.

And here’s where a bit of double-dip magic happens: I can claim my rewards at any time and they show up in my cryptocurrency wallet as both CAKE and MERL.

Then, I can take my MERL and re-stake that in Merlin Lab’s MERL pool that is currently yielding 358%. (And I most certainly will do so.)

Thus, I am compounding my initial $500 at 204% per year, and I’m generating a token that I can then use to earn 358% a year. I won’t weigh this down with a bunch of math, but assuming prices never change, my $500 would grow to nearly $1,650 in a year—more than tripling my money.

That’s the power of DeFi.

And, yes, there are risks. I don’t pretend there aren’t.

CAKE and MERL could collapse to nothing and I’d lose my original $500 plus the value of the tokens I earn.

But that’s a risk I accept because I’ve done my homework on CAKE and it seems to be a solid project. Likewise, I’m comfortable owning MERL because I’m confident the Merlin Lab DeFi site will only grow in popularity.

As I noted earlier, however, this is not a recommendation. Because, of course, there is a lot of risk here.

Which goes back to Lesson #1 from Saturday: Only invest what you’re willing to lose in a DeFi project, and spread your wealth across multiple projects.

This is the brave new world. We gotta chase opportunity while it exists…but, as Sgt. Phil Esterhous used to say on Hill Street Blues, “Let’s be careful out there.”