How I Became a Sports Real Estate Magnate

The four boys looked at the gate, wide-eyed in their excitement. A groundskeeper had not secured it properly. This was their opportunity—maybe an opportunity they’d never see again. And, so, they squeezed through the improperly secured gate—damn the crime!

They slunk though wide corridors, peeking around corners.

No one.

“I can’t believe we’re doing this. We’ll get caught,” one said to the three.

“Shut up,” three told the one.

The target lay just ahead.

A 100-yard stretch of precisely manicured grass.

This was 1979. It was late-summer, late-afternoon on a Saturday. And those four, 13- and 14-year-old boys (I was the one told to “shut up”) had trespassed through a faulty gate to steal a dream: Kicking a field goal from the grass inside LSU Tiger Stadium.

I made mine from the 33-yard line, meaning I have successfully kicked a 43-yard field goal, inside what’s known across the college football world as Death Valley, while pretending to be an LSU Tiger placekicker.

This is all totally irrelevant, save for one fact: I now legally own LSU Tiger Stadium.

Really. Legally.

I also own Sanford Stadium at the University of Georgia…as well stadiums at Alabama, West Virginia, Texas Tech, North Carolina, Wake Forest, Indiana, Iowa State, Arizona State, and elsewhere. In all, I own 21 stadiums, making me a college football real estate magnate.

This is the next chapter in the ongoing story I’ve been writing to you about regarding non-fungible tokens, or NFTs, those unique, one-off cryptocurrencies that represent ownership of unique, one-off assets. I’ve been telling you as well about the metaverse—the digital space in which we will all shop, and hang out, and pursue entertainment options.

This is another location where NFTs and the metaverse collide: digital land ownership.

Owning digital representations of real land represents a unique investment opportunity as the metaverse begins to take shape. Sort of like buying that seemingly useless parcel of scrub out in the countryside, just before a new airport is announced and the price for your scrubby patch suddenly skyrockets. (And as I always say, this is not an investment recommendation. This is aimed at showing you how blockchain and crypto are changing our world in real time.)

Why would a digital representation of a college football stadium have value?

I want you to image this scene: You’re a Georgia Bulldog football fan, and the biggest home game of the year against Alabama is coming up.

The University of Georgia athletic department sends out a special invite to season ticket holders: For $1,000, you can stand on the field—virtually—and watch the game unfold around you, life-sized. You can join the huddle. You can stand on the line of scrimmage. You can run alongside the receiver for whatever pass play was called, and experience that reception as it happens. You can sit in the back of the endzone and watch the game-winning field goal split the uprights.

Or for $300 you can “roam” on the sidelines with the team, though GPS gates prevent you from running onto the field.

Or for $100 you can “sit” in the sold-out stadium on the 50-yard-line. Again, GPS locks will keep you from accessing areas you didn’t pay for.

After the game, you can wander into the digital souvenir shop and try on all the new Bulldog SEC Champs gear, buy the stuff you like, and it will ship to your house overnight.

This is the sports-entertainment world headed our way.

And a lot of it will be based on digitized parcels of real land. A fan will log into a special website and head to the real-world GPS coordinates for Sanford Stadium; present their digital, all-access field pass to a virtual ticket-taker; and they gain entry into what is a digitized version of Sanford Stadium that is eerily and uncannily identical to the very real stadium on the UGA campus—right down to a light breeze ruffling the famous privet hedges that line the field.

Right now, there are a few digital-land crypto companies. My bet is that multiple winners will emerge in this space—multiple metaverses will co-exist because the metaverse is infinitely large.

University athletic departments will likely decide to own their stadiums in all of those metaverses so that they can then create a single portal that gives fans access, no matter what metaverse that fan is part of. (Just a sidenote: Facebook is about to become a massive player in the metaverse. And when that happens, you’re going to see metaverse this and metaverse that all over the place and the race will have begun.)

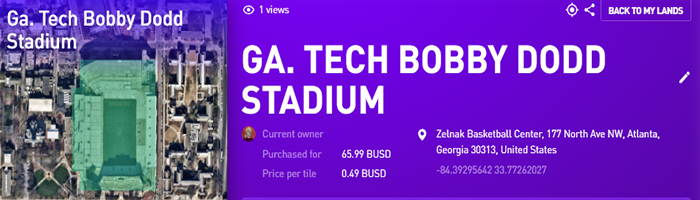

So that’s one of my longshot investment plays in the metaverse: 21 college football stadiums that I bought for between $65 and $100 per stadium in a metaverse called Next Earth. I’ve listed them all for sale for 88 Binance Coins (BNB), the equivalent of about $41,000, depending on BNB fluctuations.

Sounds crazy—yep.

100% agree.

And ultimately, I might have made a totally useless investment.

But we’re talking about athletic departments in the biggest conferences in college football. They’re flush with cash and have masses of uber-wealthy boosters to call on. And when athletic departments in the SEC, ACC, Pac 12, Big 12, and Big 10 conferences realize that a metaverse is going to open up millions and millions of dollars in additional fan-access opportunities, they’re going to happily pay 88 BNB to own their stadium.

Their return on investment will be off-the-charts. And so will mine.

At least that’s my theory.

Like I said, maybe I’m wrong. But as a huge college football fan, I’m OK with that because I still own those stadiums. And as the metaverse becomes our norm, I’ll figure out some way to monetize those digital-land assets.

Next time on As the NFT Turns, I’ll tell you about earning passive income by owning a racoon.

Stay tuned…