And now…this:

Treasury Secretary Janet Yellen was recently chin-wagging with some international banking boss-men and proffered this headscratcher, per Bloomberg and others: “The biggest surprise in the U.S. economy this year has been inflation. Inflation readings over the past several months have been surprisingly soft.”

Surprisingly soft?

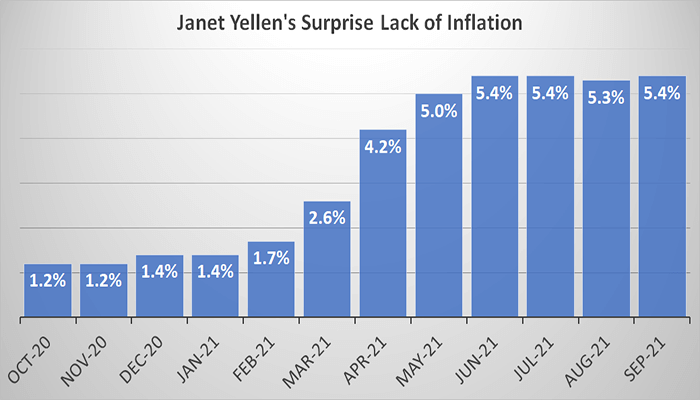

Your Honor, the people would like to offer up Exhibit 1 as evidence:

As one can plainly see, Judge, the witness is gaslighting the country, no doubt to lull the American people into a false sense of complacency…a sense that the Fed’s “got this.”

Two percent was always the Fed’s targeted benchmark. How, your Honor, is 5% and more “surprisingly soft?”

Is Ms. Yellen suggesting that monetary pooh-bahs were expecting 7%…8%…10% as a result of their years of dumping money into the economy like a New Jersey sub-contractor dumping toxic waste into a river?

I submit, your Honor, that the Treasury secretary is, to use a medical term, “off her rocker.”

With that out of the way, we move on…

Ms. Yellen also told the international bankers that Treasury “will be paying close attention to the inflation data in the months ahead. My best guess is that these soft readings will not persist, and with the ongoing strengthening of labor markets, I expect inflation to move higher next year.”

Let’s unpack that by teleporting back to February—on the 21st of the month, to be precise.

I dispatched a dispatch that Sunday telling you about (yawn!) the Baltic Dry Index, an obscure little piece of global economic data that tracks the price of moving cargo around the world on container ships.

In that piece I wrote this: “The Baltic Dry Index is a tile in a bigger mosaic that tells me an inflationary wave is soon going to roll over the economy.”

Back then, the index was right about 1,000.

Today, it’s right about 4,200.

The math says that’s surprisingly soft inflation of 320% in less than a year.

And now, the head of the Treasury is warning 2022 is going to get worse…

Hmmm. Who’d a’thunk?

I realize I sound like a broken record—or, I guess to be more current, a corrupted MP3 file. But here’s the reality: Inflation never was transitory (as Fed Chair Jerome Powell has since admitted) and it never was going to be surprisingly soft.

If Treasury truly is surprised by the “softness” of 5%-plus inflation, it says Treasury was expecting something a lot worse…which means:

A) U.S. monetary officials inherently realize that they have overstimulated the economy over the last two decades and they’re surprised those feral chickens haven’t yet come home to roost…or that;

B) Even bigger inflation is our 2022 surprise.

Either way, it’s not good.

Which is why I come back to preparation.

Hard to overemphasize just how tenuous this moment is in global financial history. There are so many fault lines under-running Western/Chinese economies these days that movement along any one of them could be disastrous on a global scale.

Much as it sounds repetitive, you really cannot own too much gold and silver these days. You can’t own too many Swiss francs (where I have the bulk of my largest retirement account invested, since I prefer safety at this moment).

And, frankly, you need exposure to crypto. That’s a controversial recommendation. I get that. There are, after all, lots of naysayers who still insist crypto is a Ponzi scheme destined to fail.

I take the opposite (and winning) side of that argument and simply note that the depth and breadth of today’s cryptoconomy—and crypto’s permeation through banking, entertainment, and business solutions—is proof that crypto is not a Ponzi scheme. It’s a permanent fixture of our world.

And very good reasons exist to suspect that certain crypto—bitcoin and Ethereum among them—are going to ultimately prove resilient in an inflationary world.

So, prepare yourself now for a surprisingly soft amount of hyperinflation to come.