Today’s missive comes with a warning label: Tread cautiously.

Maybe you heard about a little kerfuffle billionaire Mark Cuban had in the crypto market this week. He put a bunch of money into a program called Iron.Finance that was offering interest-like income of tens of thousands of percent.

You’ll find programs like this all over the cryptoconomy. Basically, you deposit one cryptocurrency and you earn crazy interest that’s paid out in the same currency or, often, in another cryptocurrency.

Well, Mark promptly saw his investment plunge in a single day when the cryptocurrency he was earning on his deposit—called Titan—tanked from more than $60 per token to fractions of a penny in just a few hours.

And here’s the thing…I was part of Iron.Finance, too.

I want to tell you about it today for the lessons I learned (and they’re probably not going to be the lessons you’re expecting).

First, I had placed only a little money at Iron.Finance: $545 to be exact. And in the end, I recouped nearly $500 of that (which I promptly put to work in a different project where I will quickly regain the lost money. More on that in Monday’s mailing).

That’s Lesson #1: Never invest a ton of money in a single project, especially in crypto.

Crypto—and most especially emerging decentralized finance (DeFi) projects like these—is the bleeding edge of tomorrow. Not every T and I has been crossed and dotted perfectly. Disasters happen.

Originally, the rumor was that Iron. Finance was a “rug-pull”—a scam in which investors are lured into a high-yield project only to have the creators shut it down and run off with all the crypto.

That wasn’t the case, actually. It was simply a poorly designed crypto project that allowed for an exploitation that ended in what was effectively the crypto version of a bank run.

So, in crypto, always spread your cash across multiple opportunities rather than fixating on one. By investing a little in different projects—and more broadly in different cryptocurrencies—you prevent disasters from wiping you out.

Lesson #2: Insane rates of return are not necessarily the lie they seem to be.

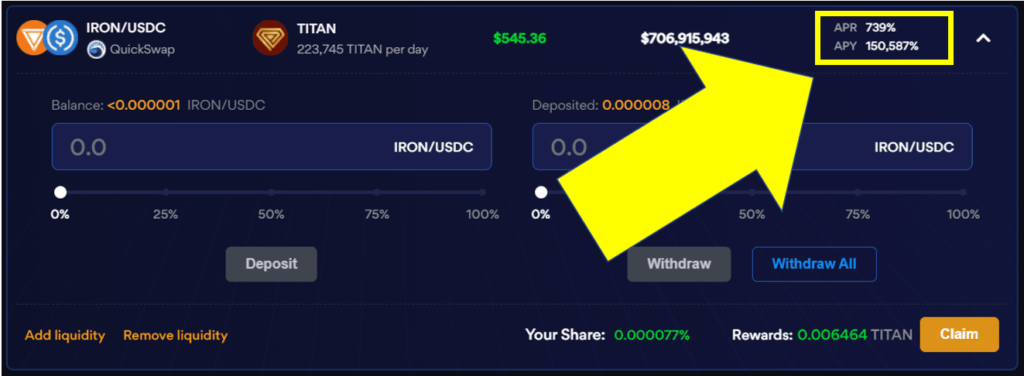

Here’s a screenshot taken within seconds of my deposit into Iron.Finance. I know the text is a tad small—sorry about that. The only information that’s important here is the yellow box that the big, yellow arrow points to. It shows the annual rate I was earning: 739% a year, or 150,587% compounded.

In a word: Insane!

And yet it’s actually small relative to some others in the crypto space. I’ve seen projects that offer as much as 1.4 billion percent.

So, the numbers race right up to “crazy,” leap across and head toward “lunatic”…and then just keep on going past “mad,” “screwball,” and “psychotic.”

They’re mind-bending in the way a Criss Angel magic trick leaves you wondering how that’s even remotely possible. People see them and reflexively think “SCAM!!!” And I totally get that.

But I was earning what I was supposed to be earning. I did the calculations every hour for the first three hours. That math worked. Moreover, I have in my crypto account right now the tokens that I earned—they’re real. They’re in my control. It’s like Coca-Cola paid you a dividend and the money is physically in your brokerage account and you can move it around as you please.

That said, those tokens are worth precisely bupkis now because of the flaw in that particular crypto. But that’s neither here nor there relative to my point that the math worked. That’s what I truly cared about with this experiment.

As for how these kinds of returns are possible…well, the reality is that they’re generally very short-lived. They often decline precipitously in days or weeks. They’re a function of how this process—called “liquidity mining” or “yield farming”—works. I won’t explain it here. It will be part of a follow-up dispatch I’m sending you Monday on how I’m earning a compounded 204% right now in a different project.

I just want to point out that these seemingly crazy rates are very often legit, so don’t immediately assume they’re a scam

Lesson #3: Don’t run away from crypto if you have a bad experience.

There’s an Arabic saying I like: “The man who burns his tongue on soup, blows on yogurt.” He’s cautious but he doesn’t stop eating.

That’s the cryptoconomy right now.

You have to be cautious, and you might get burned once or twice, but that doesn’t mean you avoid cryptocurrency opportunities. So, Iron.Finance didn’t work out for me.

OK, I accept that. But I’m earning well over 100% in multiple crypto accounts on projects like this. Over 200% in some. And, again, the math works, and the crypto I have earned is physically in my control, proving that it’s real.

We have innumerable opportunities right now to turn little bits of money into lots of money. We can sit on the sidelines and shun crypto as a fad, a flash-in-the-pan, a mania destined to crash (by the way, that’s all wrong).

Or we can use this unique moment in history—the birth of a new asset class—to grow our wealth.

On Monday, I’ll show you an example of what wealth growing can look like in the crypto universe.