Bad Juju.

We return to gold…

I sent you a dispatch last week about the Panama Route, a little-known anecdote from the Civil War in which steamers sailed the San Francisco–Panama–New York City route laden with what would ultimately amount to $200 million in gold. This California Gold Rush wealth helped the US government defeat the Confederacy and stabilize the northern economy.

Today, we’re covering something different but related—to the degree that the message is the same: Bad juju is coming, and you should own gold before the juju unleashes its badness.

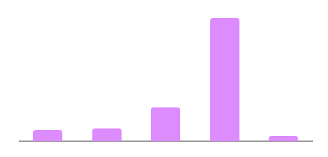

Not long ago the World Gold Council released its 2024 Central Bank Gold Reserves Survey. And amid all the numbers and charts, I came across a very simple chart of five lilac bars.

This chart, as a matter for fact:

That’s the whole chart. Nary a title nor a category, nor even a number visible anywhere.

So, of course, I had to dig deeper…

Turns out that when you mouse over each of the bars, it reveals the answer to a question the World Gold Council asked of central banks. Though the question isn’t stated, the answers suggest that the question was something like: What portion of your country’s central bank’s reserves would you expect to be denominated in gold within the next five years?

That outlier bar to the right: 66% of central banks expect their gold holdings will be moderately higher.

There was a sister question that I later saw, which was effectively the corollary, and it showed that 49% of central banks expect their dollar reserves to be moderately lower within five years.

Selling dollars to buy gold.

Hmmm…

Where have we heard that before.

Think think think, El Jefe.

Oh wait—silly, Jefe, I write about that same sentiment all the time.

Central banks are prudently ditching dollars (the most over-indebted fiat currency in the world) to buy gold (the asset that reports to no one). That tells me that central bankers know something—or, maybe worse, fear something based on what they know.

I’d vote that the latter is closer to the truth.

Given that gold pays no interest or dividend, and does nothing more useful than sit in a vault underground 24/7/365, there is precisely one reason—and only one reason—that you own gold.

Financial security to weather a crisis.

I don’t know what specific crisis bankers think they see, but the fact that they’re relinquishing dollars to snap up more and more gold suggests that they think the dollar is going to be part of the storm, not part of the solution.

Now, going back to the nameless, faceless chart… I know “moderately” seems like a milquetoast word. And it is. It’s a waffle word with zero umph. Diet air.

I mean, think about wedding vows: Do you, Jedidiah Javier McSweeney, take Daisy-Anne Marie McGillicutty to moderately love and moderately cherish… Not a relationship long for this world.

Then again, we are talking about central bankers. And on a five-bar scale, “moderately” is almost pornographically enthusiastic.

The other thing you need to know about that chart is that the data is part of a series that looks back three years, and over those three years “moderately” has grown significantly—from 46% in 2022, to 59% in 2023, to our frenzy up at 66%. Like I said, it’s almost pornographically enthusiastic to central bankers.

It’s also troubling for those of us paying attention.

A central bank gold-buying orgy has been underway for many a year now. The world’s central banks have been buying gold at the fastest pace since the 1960s, when the world was increasing fearful that the US dollar would not survive a crisis that was then brewing.

That crisis centered on the Bretton Woods arrangement from the 1940s that established the dollar as the world reserve currency backed by gold, and which established a rule that countries could convert dollars into gold at a rate of $35 per ounce.

By the mid-’60s countries began doing just that because they saw the US was managing the system about as well as a chimp manages a banana plantation. Non-US central banks held $14 billion in US currency in 1966… yet America’s gold reserves amounted to just $13.2 billion—and only $3.2 billion of that was available to cover foreign holdings.

That math doesn’t math, and central banks realized a crisis was imminent: massive inflation, which is precisely what landed in America in the 1970s.

So, what did central bankers outside of America do?

Exactly what El Jefe mentioned above: Central banks began prudently ditching dollars to buy gold.

The bankers feared a destabilizing monetary event and rushed into the only asset that central bankers could not control.

Which is the message I leave you with today: Follow the lead of central bankers outside the US.

Do not heed the claptrap that spills from bankers inside the US.

Both sets of bankers are looking to serve their own best interests, for sure. But for one of them, their best interest is in gaslighting you. They want you to believe the dollar is irreplaceable. That it’s the big dog on the block that no one messes with.

Reality is very much different.

There’s a reason non-US central banks are ditching dollars to pack away ever-more gold.

Sometimes to see yourself, you have to stop looking in the mirror and listen to how others describe you.