It’s Time to Look to Crypto-Banks and Property Overseas

This will not be a popular dispatch.

But don’t blame me—I’m just the messenger.

The message I’m sharing comes from the Dallas branch of the Federal Reserve, where researchers just published a new paper titled: Real-time market monitoring finds signs of brewing U.S. housing bubble.

The TL;DR (too long; didn’t read) version of that paper is basically this: U.S. housing prices are out of step with fundamentals. The main reason is that people are rushing to buy houses out of FOMO, or fear of missing out.

I was a financial writer at The Wall Street Journal back when the 2007-08 housing bubble imploded dramatically. FOMO and the ridiculous theory that “house prices always rise” was a big part of the recipe for personal financial disaster.

The Dallas Fed says this time around we’re not likely to see the same chain of events unfold because personal disposable income going toward housing costs is about half what it was last time around.

Maybe.

Maybe not.

But we are certainly going to see falling U.S. housing prices, something I’ve been warning about over the last year as it became increasingly apparent that inflation was not transitory and the Fed was going to have to raise rates.

In theory, inflation should be good for housing since inflation pushes real-asset values higher.

This time around, I’m betting the results are different.

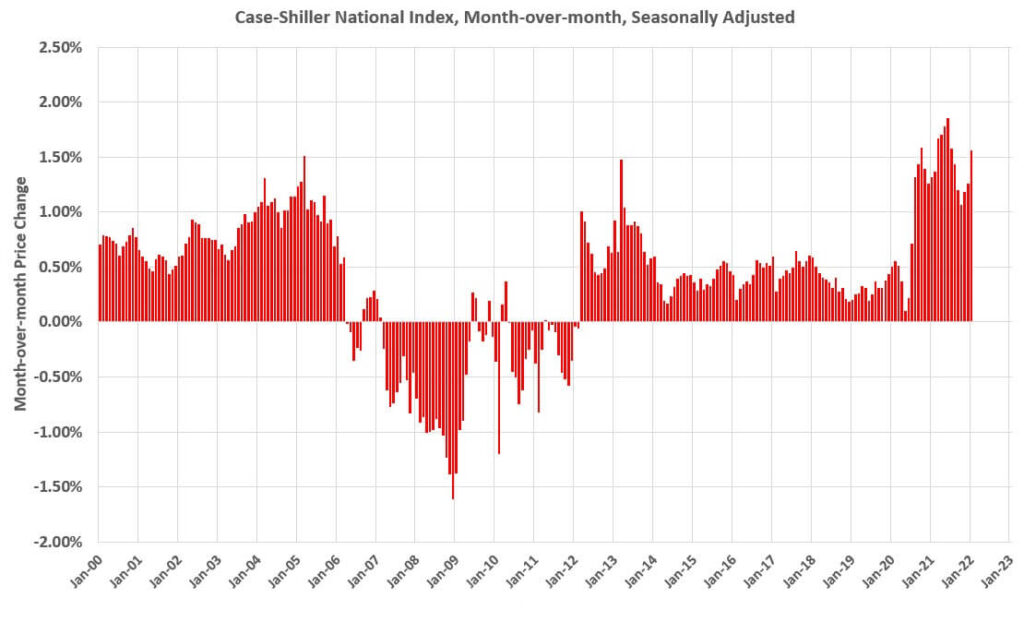

Today’s housing prices are not sustainable at any level. Take a look at this chart:

That’s year-over-year growth in housing prices in the U.S., according to S&P Case-Shiller. You can see the massive spikes higher in recent years. No way that continues.

Or consider this: The median price of an American house now exceeds $400,000…the median family income is about $67,500 per year…and the average family is carrying about $6,300 in credit card debt. Insert those numbers into a math-o-lator and it spits out this: That average family can afford a house valued at about $272,000.

See? The numbers don’t work out so well.

And just to be sadistic, let’s add rising mortgage rates to the mix. They’re approaching 5% now. They were under 3% as recently as October. The nasty math here is that as mortgage rates rise, house prices become increasingly unaffordable since every bump up in rates increases the cost of buying a house.

My bet is that house prices will have to fall to attract buyers. (And I won’t jump into this here for sake of dispatch brevity, but there’s also an increasing dearth of buyers. Homeownership among millennials—the biggest generation so far—is down 10 percentage points, half are so weary of debt that they don’t see value in homeownership, and 64% who have bought a home now express regrets for having done so.)

Back in the 1970s and 1980s, home prices generally rose amid inflation. But, then again, American families weren’t saddled with an abundance of credit card debt. Moreover, from the 1960s through 2000, the average home price in America was about 3x to 4x the typical income.

Today, the median home price is about 6x the typical income.

None of this is sustainable.

Boomers and Xers, in large part, are no longer in home-buying mode. That’s for millennials (Gen Y) and centennials (Gen Z)…yet the oldest of those cohorts don’t appear too eager to chase that tarnished American Dream.

So, Jeff, what’s your point?

I’d be a seller of houses in the U.S. today, particular second homes.

I’d take the high price while I can get it, because rising interest rates are going to extinguish the FOMO and drive prices lowers.

Then, I’d look to overseas real estate markets like Mexico, Portugal, Italy, Spain, etc., where you can still pick up property bargains.

Or if you prefer to invest at home, I’d sit on that cash (probably stick it in cryptocurrency stablecoins, like U.S. Dollar Coin, in a crypto bank and collect 10% to almost 13% interest a year). Then, I’d wait for the Fed to stop raising rates and for housing prices to bottom out.

At that point, I’d wade back into the housing market and grab a couple of very nice rental properties in desirable neighborhoods where millennials and centennials will want to live.

It’s a multi-step, multi-year process, but given where we are right now, I can’t see a path to higher real estate prices in the U.S.

There are better, safer investments elsewhere, like buying property overseas or holding dollars in those high-rate crypto-bank accounts.