Back in my earliest days as a Wall Street Journal writer in the Dallas bureau, I was visiting the mothership in New York City when I bumped into the managing editor in the hall. He was the grand pooh-bah of the paper. At that point, I’d been with the Journal just a few months; he had zero reason to know who I was.

“Hey, Jeff,” he said to my astonishment. He went on to tell me that he liked the Heard on the Street investment columns I was writing, but he had a suggestion: “Tell readers what to do. Don’t tell them what not to do. They want to know where to invest—not where they shouldn’t invest.”

Said another way, he was telling me, “Don’t write about the problem; write about the solution.”

To which I bring to you a story I read recently in Fortune.

For my taste—and my knowledge base—it was a largely misinformed collection of incorrect information about various topics. But the message that I want to share with you today stems from this gem:

“Gold, the world’s most prized ‘store of value,’ has proven a poor investment over the past nearly half-century. Since 1974, it has precisely doubled in price to $1,800 an ounce, while the CPI, the main measure of consumer inflation, rose six-fold. It’s anything but an inflation hedge.”

First, that assertion is dead wrong, factually.

On Jan. 1, 1974, gold was about $132 per ounce. So, gold is up nearly 13x since 1974—not 2x.

Second, inflation between 1974 and today means that what cost you $132 in 1974 now costs $750.32, according to the Bureau of Labor Statistics, the arbiter of official U.S. inflation data (and, yes, BLS data is questionable because of the all the numerical massaging that happens, but those are the official numbers, so we’ll go with that).

Now, I do not have a Fields Medal in, say, combinatorial math…but based on what I learned in first grade at St. James Elementary in Baton Rouge, Louisiana way back in the early 1970s, before all this “new math” emerged, $1,800 is bigger than $750.32.

Assuming that’s still the case today, then gold wins the battle against inflation.

Hands down.

That $132 gold ounce from 1974 buys more than double the amount of goods today than it did nearly 40 years ago.

But, frankly, what I’m really getting at is the idea of “OK, then tell me why to own gold—not why I shouldn’t own it.”

And since Fortune did such a lousy job of that, allow me to step in and offer some guidance…

As you know I like to do, we go to the charts…

First, there’s this one:

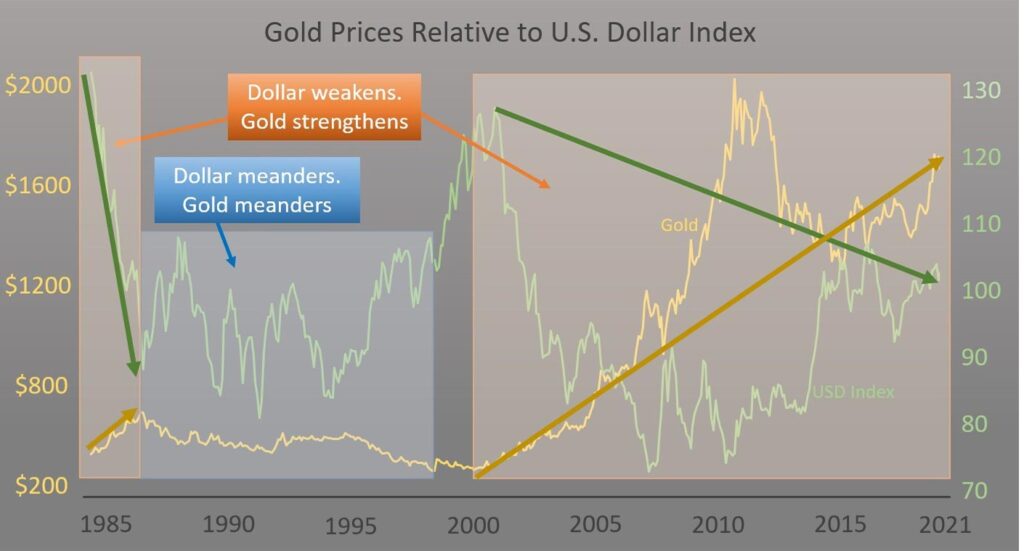

That’s gold vs. the greenback. In this case, I’m using the U.S. Dollar Index, which measures the strength or weakness of the dollar relative to a basket of major, world currencies.

I mean, the trend here is pretty darn clear. Dollar goes down, gold goes up. Dollar goes up, gold goes down. Dollar goes nowhere, gold does nothing much.

What this says in very simple terms is that gold is the dollar’s foil—the Abbott to the dollar’s Costello. If we believe the dollar weakens from here, then gold will continue to rise.

Question: Do we believe the dollar weakens?

Absolutely. I wrote about this in the March issue of the Global Intelligence Letter, and I fundamentally believe that America’s fiscal situation is bad juju for the dollar. Way too much debt now. Speaking of which, I give you Chart #2…

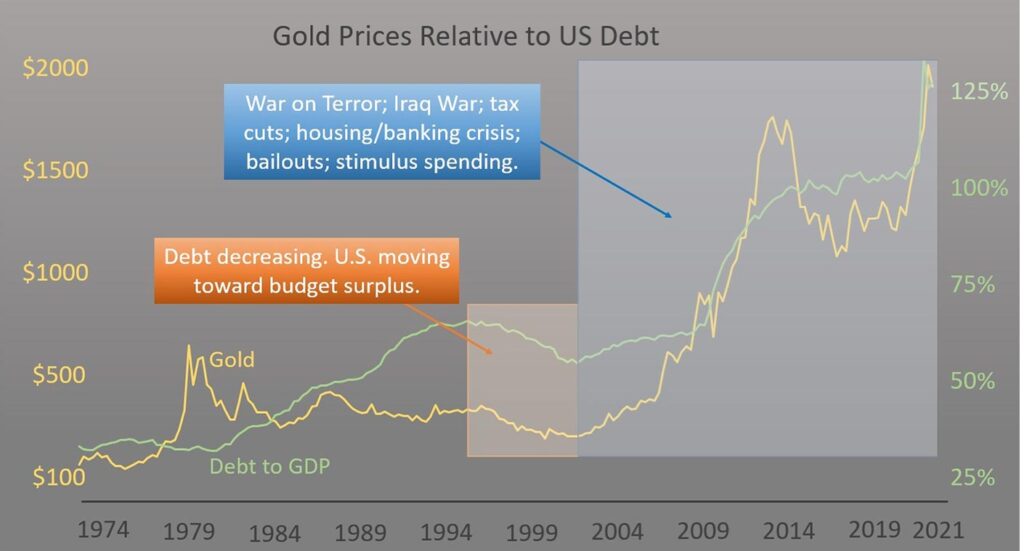

That’s gold relative to America’s debt. In particular, that’s gold from the time Nixon fully unshackled it from the dollar, relative to debt as a percentage of America’s gross domestic product.

I tend to disregard that first decade. Gold had finally been freed, and it was a moment of rampant inflation—two outlier events that fueled gold prices. From that point through the mid-’90s, the gold market wasn’t concerned about America’s rising level of debt because at its worst, debt remained below 65% of GDP—and that’s a level that universally causes precisely zero consternation.

In the mid- to late-’90s, as debts began to shrink and America’s budget deficits turned to surpluses, gold followed the trend. It sank. The market had no reason to fear a fiscal crisis. Gold went into hibernation.

But then came the 21st century…

D.C. discovered financial meth—debt—and it loved the high. So much so that, just like any junkie kicking the can of recovery off down the road, successive Congresses and presidents basically said, “Ah, to hell with it; it’s just money. Let tomorrow’s generations worry about that—I have another election to win!”

Debt in terms of the raw number of dollars borrowed exploded like never before. Debt relative to the economy (GDP) raced from irrelevant to alarming.

So, gold awoke from its long hibernation and said, “OK—I got this…”

And here we are today: a weakening dollar, exploding debts, and the gold market telling anyone who will listen: “Own me, because I protect you against America’s rotting fiscal circumstances. And, oh, by the way, I’ll probably continue do pretty well when inflation hits—regardless of the disinformation you might read elsewhere.”

That’s my story for the day: Gold’s real purpose.

It’s why I recommended a particular gold ETF to Global Intelligence Letter subscribers back in March. We know where the dollar is going. We know where debt in America is going. Which means we know where gold is going. And that ETF is now up 14% in short order, because the rest of the world knows where the dollar, debt, and gold are going.

Writers can write what the want (based on wrong facts), but 40 years of charts definitively show that gold, the dollar, and America’s debt are bed buddies. If you think the dollar sinks and debt rises from here…you gotta own gold. If, conversely, you think the dollar rises and debts begin to fall, then avoid gold (and seek medical help; you’ve fallen and hit your head).

You know were I stand I on this: A debt crisis is brewing; a dollar crisis happens this decade.

Gold has a long march higher from here.