Back in my college days at Louisiana State University, I needed to take a class I was sure to hate: philosophical logic—philosophy peppered with algebraic-like symbols and geometric-like theorems.

Thing is, I actually ended up loving the class and this idea of seeking and defining truths, possibilities, and probabilities through a form of mathematical logic.

Here’s an example of how it works: If you walk into my kitchen and open my freezer and see 1,000 red popsicles, you could rightly fashion a set of truths, possibilities, and probabilities:

Truth: Jeff’s freezer is filled with popsicles.

Probability: Jeff likes popsicles.

Possibility: He likes strawberry…maybe cherry…or maybe raspberry.

Which brings me to the new, monthly statistics on gold holdings among the world’s central banks. The World Gold Council released the data this week. The high-level takeaway is that central banks in April (the data is always a month or so behind) added a net 69.4 tonnes of gold to official reserves.

The granular data, however, is where the devil is stacking up his details…and it’s where I come back to my red popsicle analogy.

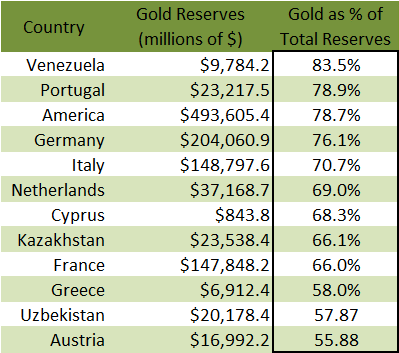

But first, take a look at the devil’s details in this chart of the countries with the 10 largest amounts of gold relative to each country’s overall stash of financial reserves:

What I want you to pay particular attention to is the column on the right—gold as a percentage of total reserves. Those are not small numbers.

America might be the most interesting of the bunch. A country in which high-ranking economic leaders regularly dismiss gold as archaic, a relic, and useless has nearly 80% of its financial reserves in gold.

You smell that? Smells like someone burnt the hypocrisy again.

But back to those popsicles…

Truth: The world’s central banks hold a boatload of gold in reserve, and those reserves have increased every year for the past 13 years by a combined 20%.

Probability: Central bankers see gold as a necessary store-of-value relative to fiat currency like dollars and euros, despite the musings of some central bankers and Treasury officials who want the average Joe and Josephine to believe the opposite.

Possibility: Central bankers are adding gold because they’re worried about a global monetary crisis (likely centered on the dollar, though possibly the euro).

The only truth we can prove is that the world’s central banks do, in fact, own an abundance of gold and that they have, in fact, increased their holdings meaningful over the last baker’s dozen of years.

Everything else is subject to interpretation, speculation, dissembling, and spin.

But I think my interpretation is pretty close to the truth. In fact, I am quite certain I’m not wrong at all and that my interpretation—a weakening U.S. dollar, a potential currency crisis, a pending debt fiasco—is a primary reason central banks are increasingly snapping up gold.

Why else would central banks be holding such large percentages of gold?

Outside of jewelry and collecting coins (and maybe a tiny bit of consumer-electronics production), the only reason to buy gold is to store it as a financial asset—an insurance policy to guard against a weakening dollar.

Which is precisely why we have exposure to gold in the Global Intelligence portfolio , and why I have been counseling friends, family, and my readers to buy gold for more than a decade now.

So, grab yourself a popsicle. And some gold. Central banks are openly telling us we have some wealth destruction ahead…and they’re telling us how to protect ourselves from it.