Turn the Doomsday Prophecies About Inflation to Your Advantage

And just like that, back to reality.

The last week or so was nice. Quiet. I did a lot of walking around Prague with the family.

I also did a bit of crypto trading—sold one position for a 7,278% gain. That was my remaining holdings of a crypto called CEEK VR, for which I saw big possibilities back in mid-2020 when it was trading for around $0.01 per token. I sold it when it was above $0.71. (The first half of that position I sold at a gain of more than 10,000%.)

That’s the good news.

The bad news is that I woke up one day last week to this headline on my iPhone newsfeed: The Fed’s Doomsday Prophet Has a Dire Warning About Where We’re Headed

That doomsday prophet is Thomas Hoenig—not a name a lot of people will necessarily recognize.

Hoenig spent his career inside the Federal Reserve, once serving as president of the Federal Reserve Bank of Kansas City, which gave him a seat on the all-powerful Federal Reserve Open Market Committee. It’s basically the Eye of Sauron (for you Lord of the Rings fans) in that it rules the land.

In this Hobbitonian analogy, Hoenig is Gandalf, a powerful wizard aimed at stabilizing the forces of good and evil. Alas, unlike in the fictional Middle Earth, this wizard wasn’t so successful.

For years, Hoenig was the dissident voice, warning of serious consequences if the Fed kept up its policy of basically tossing bags of free money into the economy.

Retirement hasn’t softened his stance. He’s still the same dissident. Only now his message is more dire.

At this point in the game, “There is no painless solution,” Hoenig recently told an interviewer. The fix is “going to be difficult. And the longer you wait, the more painful it will end up being.”

The game Hoenig’s talking about is inflation.

As I’ve been writing for around a year now, inflation was always going to be the end result of the post-COVID cash party that the Fed and Congress launched in 2020.

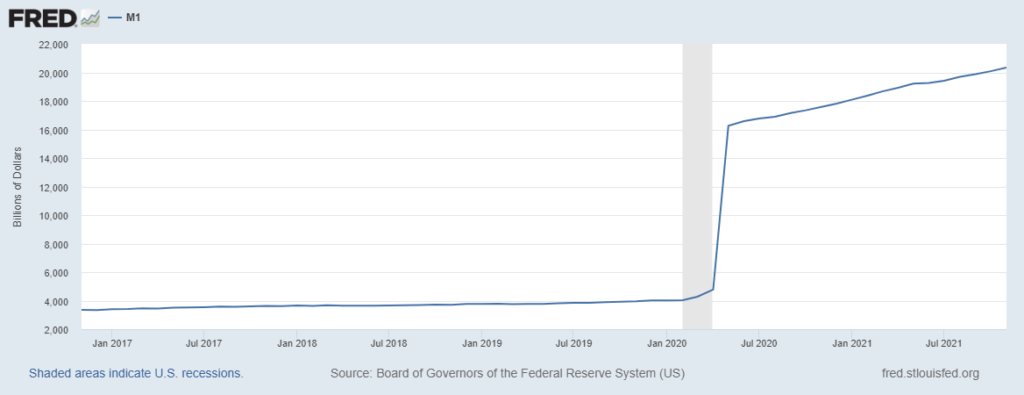

Take a look at this chart…

Don’t worry about the small numbers. Just note the trajectory of the blue line. This is the M1 money supply, the primary measure of dollars in the economy. This data comes directly from the Federal Reserve Board of Governors. It’s tracking money supply from January 2017 until November 2021.

That rocket-ship spike is the distributions of cash—free money—due to the pandemic in early 2020.

The money supply rose to $16.3 trillion by May 2020 from only about $4 trillion in February 2020.

Since then, the money supply has increased another 25% to more than $20.3 trillion. So, 80% of all the dollars ever created under the Federal Reserve’s stewardship (dating to 1914) were born in the past two years.

That is a problematic level of money-supply growth—like filling the bathtub with water, then opening a window and bringing in a fire hose to “top it off.”

Those are real dollars flowing through the economy, and economically speaking such a rapidly increasing supply of cash is fuel for inflation. (As the money supply increases, you have more dollars chasing the same amount of goods and services, which pushes prices higher.)

Economists, the media, the Fed—they can blame inflation on a pandemic-impacted supply chain, and they can repeat the (boneheaded) idea that it’s all just a temporary blip…that the supply chain will be sorted soon, and we’ll quickly return to a Goldilocks “not-too-hot, not-too-cold” economy.

Ahhh, fairy tales. Most of them have dark origins.

Hoenig sees the darkness. He warns that those who see free money as the light to lead us through the darkness are charlatans selling a tale that’s simply not true. Rather, the tales are told in order to spin a happy ending that keeps us plebes content and unworried about the darkness descending.

What does Hoenig see coming from this fairy tale the Fed has been selling for years?

High unemployment.

Social instability.

Years of economic malaise.

I’ll add to that, a lost decade for stocks and bonds.

A boom in oil, industrial commodities, and food.

Much higher prices for gold and silver. (You’ll find my recommended ways to play these trends in the Global Intelligence Portfolio.)

For now, welcome to 2022. It promises to be a challenging year for the Fed and for inflation. But that just means there are opportunities for us.