Plus: Inflation Is Not Dead.

Maybe it was all just a series of non-credible threats?

If so, well it was a pointless exercise in imposing vast losses on America’s retirees and those racing toward their golden years.

Alas… it’s likely not over. Which means more ill tidings for American nest eggs.

We start by returning to Señor Trump’s election victory. In the months running up to the election, and in the early months post-election, 47 was all about mass deportations.

Concerns emerged all over the financial and economic press that mass deportations would disrupt the American food chain—sending grocery prices higher—because so much of the ag sector is built on legal and illegal immigrants.

Alas, aside from some high-profile instances, mass deportations have not materialized. Through his first 100 days, Trump’s deportation numbers trail Prez. Biden—and even Trump’s own history during his first term as poohbah-in-chief.

So, was Trump’s talk of mass deportations a non-credible threat? Red meat on which the base might grow fat and happy?

Who knows?

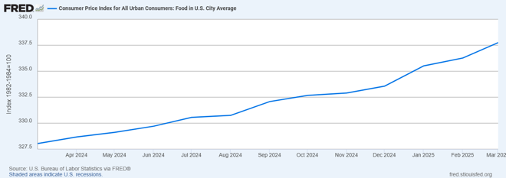

All I can say with certainty is that all the chitter-chatter I see in Twitter/X about food inflation coming down is just orange-pilled propaganda/disinformation. Some proof, by way of the Federal Reserve Bank of St. Louis. This is the Food category for the Consumer Price Index for All Urban Consumers:

I don’t see any hint of a price decline… meaning inflation continues to sap family wallets.

Now, we have another threat that might or might not be non-credible: Tariffs.

Trump has a history of talking a big game, but then playing “small ball” where the rubber and road come together. We’ve seen tariffs bounce all over the place, like a pinball ricocheting off bumpers.

Hard to know with any certainty if any of those tariffs actually stick.

But if they do, it’s bad news for Americans.

All the pablum about “foreign countries pay the tariffs” is simply wrong.

Truth is, Americans pay the tariffs. Period. No two ways about it.

Which is why small business owners are all over the news and social media complaining about vast cost increases on their business because of the tariffs. They’ve brought receipts to show exactly what’s happening and why they’re pushing those costs off onto their customers—what you and I know as “the American consumer.”

And that brings us back around to… Inflation.

You’d be forgiven for thinking that inflation is on the wane.

Not so.

Per the March Consumer Price Index:

- Food overall is up 3% year over year.

- Meats, poultry, fish, and eggs are up 7.9%

- Food away from home is up 3.8%

- Shelter is up 4%

- Medical services are up 3%

- Motor vehicle maintenance and repair is up 4.8%

- Motor vehicle insurance is up 7.5%

- Energy services (utilities, heating, etc.) is up 4.2%

The only saving grace is that oil prices are down huge, which means gasoline is down nearly 10%. Airfare is down as well, a function of lower fuel prices and declining demand among US consumers who are prepping for a recession, and foreign visitors who are increasingly skipping holidays in Trump’s America.

This inflation is not going away.

The tariffs that currently exist are driving prices higher already, and even if Team Trump negotiates lower tariffs than he has unilaterally imposed, we’re still taking about tariffs with a 10% baseline.

That’s a 10% tax on Americans.

And, no, you really cannot avoid it because so much of what American consumers and businesses consume are raw or finished goods from overseas. As such, tariff-induced inflation is baked into our future.

All the more reason you absolutely need a nest-egg strategy built around ways to bolster the income your portfolio kicks off, and which grows your wealth as the dollar declines in value globally.

To that end, I have revamped my upcoming Passive Income Workshop to match the new needs that are clearly emerging in this second Trump term.

I say this all the time, but I need to repeat it: I am not making any kind of political statement here. I am just looking at the facts as they exist—the tariffs, the negotiations, Trump’s comments, federal data, and the anecdotes of small-business owners already raising prices.

All the facts point to higher prices that American pocketbooks must absorb… meaning higher prices that American nest eggs have to overcome to help their owners live a comfortable retirement.

And all of that has to happen amid a stock market that is uber jumpy, because it doesn’t know where the next Trumpian body blow will come from.

I launched into this dispatch by talking about non-credible threats. And we still might learn that Trump’s tariffs, like mass deportations, are a non-credible threat—something big and boisterous just to get the attention of the people Trump wants to send a message.

But inflation is not a non-credible threat.

It’s the real deal.

And it’s draining nest eggs continually. No end in sight.

If you want to protect your financial future from what’s coming, join me for my revised Passive Income Workshop.

I can promise you that you will learn how to access novel ways to grow your nest egg… and generate above-market yields… so that you can survive the non-credible threats and the inflation that is certain.