Today, we pull out our Greek mythology textbook and we turn to the story of Scylla and Charybdis.

I only know this story because of that lyric from The Police song, Wrapped Around Your Finger: “Caught between the Scylla and Charybdis.”

Years ago, I had to go look that up because I had no clue what Sting was singing about.

Turns out he was singing about America’s Federal Reserve, nearly 40 years into the future…which is today.

But before we get there, a brief bit of mythological catchup: As Odysseus sailed between the island of Sicily and the Italian mainland near Calabria, he came upon the Strait of Messina, the lair of the sea monsters Scylla and Charybdis. Death lay on either side of the strait. Odysseus was told to choose a path closer to Scylla and lose but a few men along the way, rather than face certain death for all by sailing too close to Charybdis.

And thus we have the story of the modern Federal Reserve…

Right now, the Fed is caught in a Scylla-and-Charybdis moment of its own making.

The Fed is sailing a ship named the S.S. Inflation. It’s not a particularly seaworthy craft, shot full of holes and taking on water. But the Fed is certain it has the tools to safely sail this ship through a set of dueling disasters it cannot avoid.

On one side of this unnavigable strait is a financial crisis…on the other side is a monetary crisis. And, to be clear, there is no path down the middle that safely evades both monsters.

Financial Crisis:

Inflation right now is running at nearly 4.2%, a level not seen in more than a dozen years. Yet interest rates on 10-year Treasury debt (America’s governmental bonds) is 1.63%.

Question: What investor sticks money into a safe investment knowing the income they’ll earn can’t even keep up with the rising cost of living?

In short: Who buys while fully expecting to lose money?

I’ll tell you who—nobody!

The buyer of Treasury paper right now is the Federal Reserve. In effect, Uncle Sam is issuing and buying his own debt. It makes a dog chasing its own tail seem somehow logical.

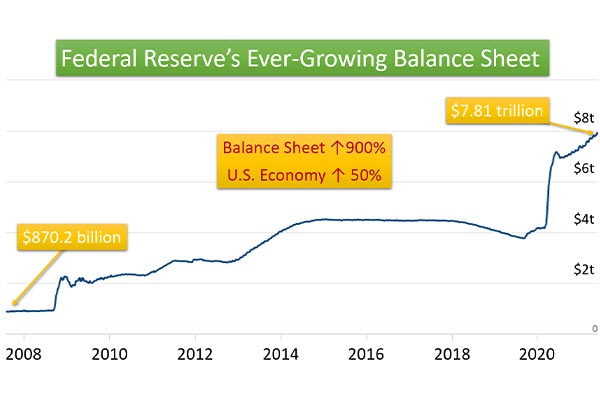

Here’s the chart of just how out-of-control Fed buying is…

That’s the Fed’s balance sheet—the assets the Fed owns. Right now, those assets are primarily Uncle Sam’s debt. (And do not be surprised if we reach a point in the next crisis where the Fed is buying individual stocks on Wall Street. That will be sign that financial Armageddon is upon us.)

As the economy sputtered to a 50% overall increase in the last 13 years (about 3.2% a year, on average), the Fed’s balance sheet grew by 900% (more than 18% a year).

In terms you and I care about, it’s like earning 3.2% more every year on your paycheck, even as you increase your debt by 18% a year. The math is going to come back to haunt you at some point.

Fed buying suppresses the interest rates Uncle Sam must pay because it creates artificial demand. The Fed knows, however, that if it stops buying—if is “tapers,” in Fed lingo—interest rates will have to rise in order to attract natural buyers.

Rising interest rates will yield a financial crisis for government, since the cost of running America (the cost of borrowing more and more money at higher interest rates) and the cost of running businesses and households that rely on debt, will escalate.

Monetary Crisis:

The world realizes the U.S. dollar is an emperor sans duds. That’s why countries have been replacing the dollar in their central bank reserves in recent years, and why gold prices have been pushing ever higher since the turn of the millennium.

If the Fed choses to continue buying Uncle Sam’s debt—what you’ll see referred to as “monetizing the debt”—it is willfully weakening the dollar. It’s the Fed basically saying it will issue as much money as it needs in order to buy as much debt as our financially illiterate Uncle needs to sell. And, of course, every new dollar that is printed (or created electronically, as is the case) devalues every existing dollar.

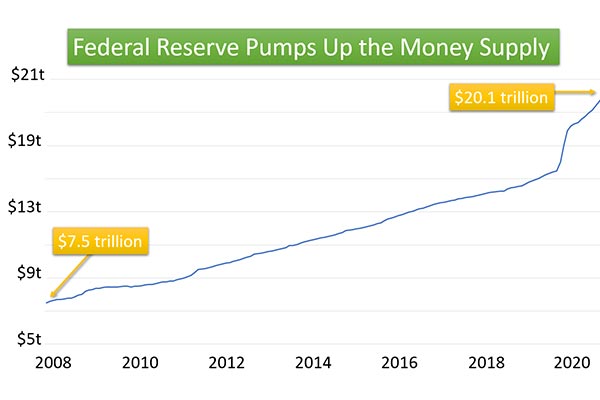

Here’s how many dollars the Fed has been creating in that same 13-year stretch…

Again…the economy was growing just over 3% annually, but money supply has grown by more than double that at a nearly 8% annual rate.

You can ask the same question here as I asked above: Who wants to own a piece of paper that will be worth increasingly less as more and more dollars materialize?

Scylla or Charybdis—Financial Crisis or Monetary Crisis.

Which will the Fed choose?

It will have to choose one since it either stops buying Treasury debt or it continues buying Treasury debt. There is no magical third way in which leprechauns riding unicorns lead Uncle Sam through a gumdrop forest to safety.

My bet: The Fed chooses Monetary Crisis by letting the dollar fall to pieces (which is why the Fed keeps saying it will not hike interest rates until at least 2024, despite inflation).

Like Scylla, a monetary crisis is the slightly lesser of two evils.

A financial crisis would be devastating to banking, the economy, and government. That’s harder to fix.

While a Monetary Crisis is no walk in the park, the Fed could ultimately shackle the dollar to gold/silver once again and instantly regain global credibility and stability for the greenback. I am not explicitly saying that’s the Fed’s path forward. I’m just saying that path is well-trodden historically, and is a much easier fix than is triaging an entire economic, financial, and political system under duress.

All of which is why I continue to counsel ownership of gold and hard assets (and why I have a new recommendation along these lines in the upcoming June issue of the Global Intelligence Letter).

The S.S. Inflation is approaching Scylla and Charybdis, and the passage promises to cause a great deal of destruction somewhere…