Things my children have never known: black-and-white TVs, rotary dial phones, cars without seat belts, Schoolhouse Rock!, the Cold War…and inflation.

It’s that last one I want to talk about today—though, clearly, Schoolhouse Rock! would be much more enjoyable. “Conjunction junction, what’s your function?” (That will be stuck in your head all day, now. Sorry about that.)

But on to inflation…

I still remember inflation—I mean real inflation. Not this 98-pound weakling inflation the Federal Reserve has been so desperate to “control” for the last 30 years. I’m betting you, too, remember real inflation. I still recall the Saturday morning I went with my grandmother to a Louisiana National Bank branch on Corporate Boulevard in Baton Rouge, so that she could transfer some money into a certificate of deposit. She was slightly miffed that the rate was only 16.3% when she’d seen an ad several weeks earlier for 18%. It was the early 1980s.

I’ve had that near-ancient image in my head recently. Like I noted a moment ago, we haven’t seen meaningful inflation in the U.S. for decades. The last time we touched 5% was 1990. Since then…all downhill.

That, however, is soon to change. For inflation is headed our way.

I know, I know…this talk of inflation has popped up sporadically over the last 10 or 15 years and nothing ever came from it. All sizzle, no steak.

This time is different.

And much of Wall Street is in trouble (though not all of it). The dollar is in trouble. Your wallet is in trouble. The bigger fear is that Uncle Sam could well be in trouble.

But first, why is this time any different that the recent past?

The path by which money has flowed into the economy is very different this time around. Back in the wake of the Great Recession/Housing Crisis, the gazillions of dollars the government spent in bailouts largely went to mismanaged banks to keep them from collapsing. That money never really made it into the economy; it just sat on bank balance sheets as a stabilizer.

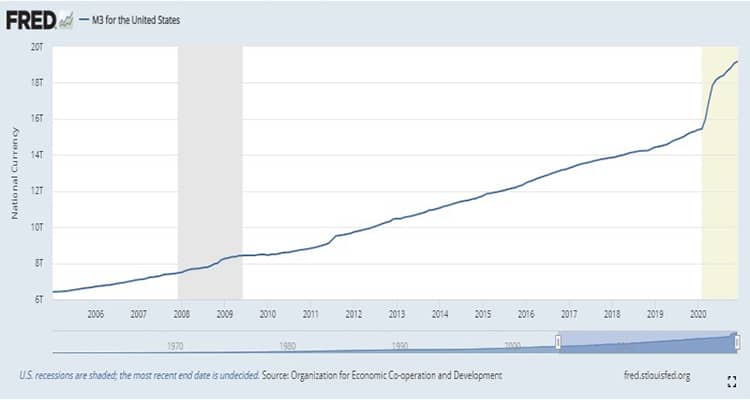

This time around, much of the money went directly into consumer bank accounts. That is literally dumping money into the economy. You can see it, plain as day, in this chart from the St. Louis Federal Reserve Bank branch…

That’s the U.S. money supply—the George Washingtons and Ben Franklins actively zipping through the economy or sitting in checking accounts and CDs and such.

Look at that gray, shaded area—the Great Recession. Aside from the tiniest hiccup higher around 2009, the money supply basically grew at the same pace at which it has pretty much always grown. Just shows you that the trillions of federal bailout bucks dispensed at that time didn’t really spillover into the broader economy.

Now, look at the yellow, shaded area—the pandemic. Money supply exploded higher.

From 2007 to 2009, money supply grew by about $1 trillion dollars, a 12% increase. During the pandemic, money supply so far has grown by nearly $4 trillion, or 25%…and the Biden administration is on the cusp of dropping another $1.9 trillion into the economy, with much of that headed directly to consumer bank accounts. That will be $5.9 trillion on top of the $15.4 trillion that existed pre-pandemic.

At this point I need to ask you a question: If you dump a packet of raspberry Kool-Aid powder into a pitcher of water, what color will the water be?

Exactly.

That is how clearly inflation is headed our way. It’s an industrial-sized tub of Kool-Aid powder about to dump into a blow-up kiddie pool.

Of course, this is what the Federal Reserve wants. It has been trying to kick-start inflation for more than a decade and failing miserably at it. So, now, the Fed has stated it will sit on the sidelines and watch for a while. Typically, the Fed intervenes in various ways to maintain inflation in the 2% ballpark. This time around, the Fed wants higher inflation.

Why?

Uncle Sam is a debt-drunk mooch with the self-restraint of a chimp in a banana factory. And that’s being kind.

The U.S. has so…much…debt. As I noted in the March issue of the Global Intelligence Letter, Uncle Sam’s soon-to-be $30 trillion in debt means that if you spend $1 million a day, every day, from the day you were born until the day you die at age 100, you’d need to live 822 lifetimes to spend $30 trillion.

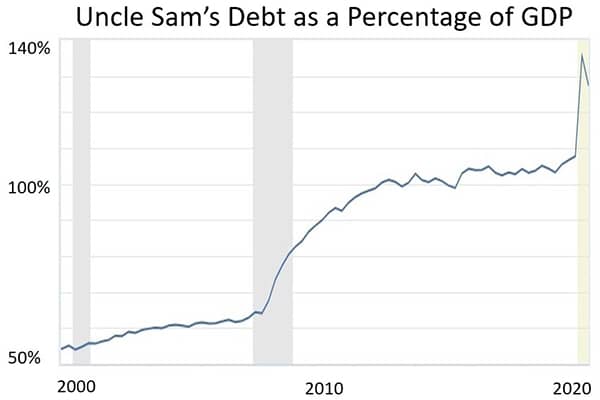

At this point, U.S. debt is an unsustainable 130% of the country’s overall economy. With the new stimulus package, that goes to 140%—and that doesn’t include the ongoing debt Congress relies on every year to keep the lights on in the U.S. This is what that looks like, before the new stimulus arrives…

The only way to deal with debt this large is through default or inflation.

I’m not ruling out a limited default at some point later this decade. But in the meantime, eroding the value of money is the sneaker path—i.e., the path the government will always prefer. It is, as I referred to it in the Global Intelligence Letter, a game of Three-Card Monte, with the Fed running the hustle. Here’s how it works:

- Congress overspends—the annual budget deficits, tax cuts, expanded Medicare coverage, COVID-relief stimulus, bank bailouts, etc.

- The U.S. Treasury pays for that overspending by turning it into debt that it sells to investors and foreign governments.

- The Fed manipulates interest rates to create inflation—the red queen in the game—which erodes the value of today’s dollars.

It’s that Fed manipulation that ultimately makes it easier for the government to pay its debt. The manipulation lets Uncle Sam use tomorrow’s cheaper dollars to pay off today’s mountain of debt.

Which is why I worry about Wall Street. Bond prices are already rising, an indication that bond jockeys (magnitudes smarter than the stock guys) see what’s coming. A real bout of inflation—and I’m saying it exceeds 4% and pushes toward 5%—will freak out the Street. Stock prices will fall, especially for high-flying tech stocks.

Commodity stocks, however, will do very well. Gold will do well (I’ll bring you a more in-depth column on gold soon). I’m really curious to see how bitcoin performs; I think it could suffer an initial pullback as investors stop to consider crypto in its first-ever inflationary economy. Ultimately, however, bitcoin powers ahead as investors and savers realize it protects them from what will be a weakening dollar.

So, that’s what’s coming at us—our first real taste of inflation in more than 30 years.