Lemons, Chinese AI, and Market Selloffs…

When the world hands you lemons… too many investors freak out and throw the lemons away.

Others of us use that moment to buy more lemons… because we know they’re going to turn into lemonade.

Case in point, the giant freak-out that roiled stock and crypto markets when a Chinese AI suddenly appeared. DeepSeek, as it’s known, popped up to show that really good AI doesn’t necessarily need the money and resources that Wall Street has assumed.

The realization caused a massive panic on the Street and throughout the cryptosphere. Nvidia, the poster child of the AI investment craze, lost 18% of its value on Monday last week.

Nvidia’s bed-wetting (to be polite) sent Wall Street diving. Bitcoin, the bellwether for the crypto markets, tumbled to $98,000 from more than $105,000.

I tried DeepSeek. I asked it to build the coding I need for a particular trading algorithm on a website I use. I’d been working on the same thing on ChatGPT days earlier. And frankly, ChatGPT bungled it repeatedly—constantly introducing errors.

DeepSeek?

Nailed it the first time.

Impressive.

Which means I understand why the investment community lost its collective mind. DeepSeek was vastly more cost effective to build, which upends a lot of the thinking on Wall Street and elsewhere.

But here’s what I posted on Twitter as the selloff happened:

Just a reminder for the youngsters who weren’t around for the OG dot-com boom. This sh** ain’t new.

Sell offs on dumba** rationale always correct. Deep Seek is just the shiny new object today. It won’t be the shiny new object tomorrow. There is ALWAYS a better mousetrap just a day away.

Use these moments of irrational panic selling to load your bags with the quality names. This is temporary.

And temporary is exactly what transpired.

Nvidia began to rebound, and bitcoin moved back above $105,000.

There’s a lesson in that: Don’t panic because of some random news event.

One of the truisms of Wall Street that I vehemently disagree with is the notion of something called the “efficient market hypothesis”—the idea that asset prices reflect all knowable information.

At an academic level, that might be true. But I’ve never really cared about the ways academic theories and theses apply to asset prices. Academics work in a vacuum, and real markets work amid chaos.

What you think you know one minute—that DeepSeek is better than ChatGPT—is not what’s important the next.

Why would bitcoin be worth 7% less just because a Chinese AI appeared? And why would bitcoin’s price suddenly be worth its original value a couple days later?

That is not an efficient market in the slightest. It’s an inefficient market. Or if it is efficient, then it is also emotional and reactionary in a knee-jerk, non-thinking way.

And in either one of those—inefficiency or reactionary—we as thoughtful investors have a leg up on the market… thereby negating the idea that the markets are efficient and that investors cannot outperform them.

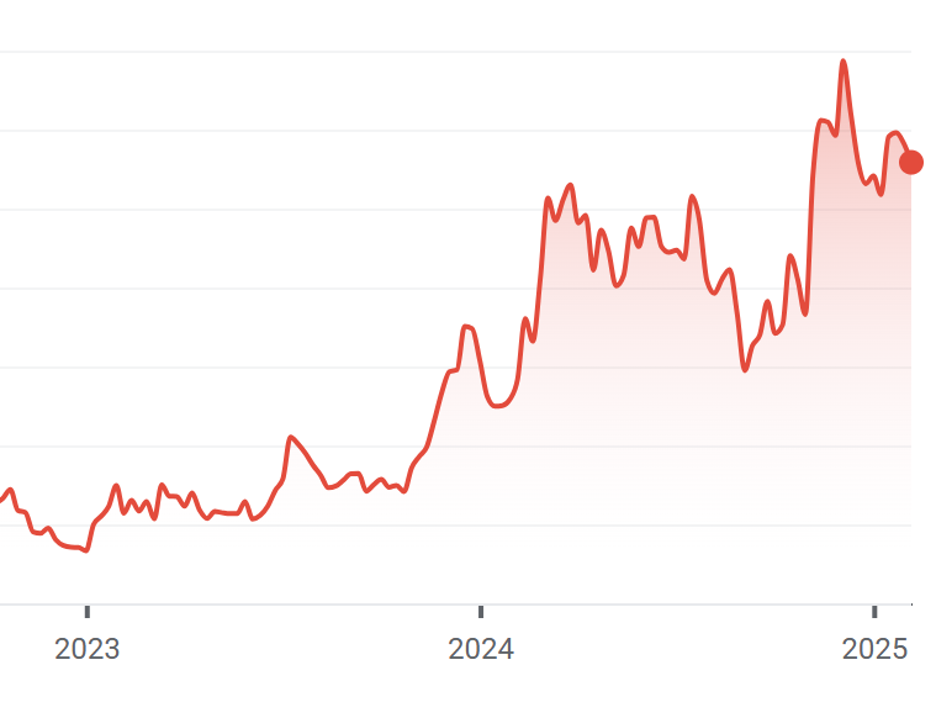

Great example: Coinbase, one of the world’s leading crypto exchanges, which trades on the NASDAQ.

Back in in the summer of 2023, the SEC announced a largely anticipated lawsuit against Coinbase based on some half-baked rationale rooted in bureaucratic stupidity tied to securities laws fashioned a century ago, before anyone had even thought of digital money.

On the day the SEC filed its lawsuit, Coinbase shares crashed, down 27% quickly.

I read the lawsuit to see what the SEC was alleging, and then immediately put in a buy order for $10,000 worth of Coinbase stock. The SEC lawsuit was ridiculous. It was clear to me, a non-lawyer, that the SEC was simply wrong. It was just an example of overreach by an agency hellbent on attacking crypto any which way, since former SEC Grand Wizard of Uselessness Gary Gensler muffed so badly on the FTX/Sam Bankman Fried scandal.

The market’s knee-jerk reaction was to shoot first, to hell with any questions.

The soberminded decided to ask the questions first… and then pull the trigger—to buy, not to sell.

Today, my $10,000 investment is about $66,000—a 6.6x return in about 18 months. Not gonna complain about that.

This is why I am always counseling to buy when crypto is down because of some exogenous event. We are still well entrenched in a bull market. But even in bull markets, red days of stupidity regularly emerge. And you have to use those days to load your bags even more.

I’ve been using down days to add more Solana and various AI tokens. I’ve been using temporary downdrafts in Solana to initiate leveraged trades so that my money is working 20x harder. Recent gains I’ve clocked include: 134.5%, 161.2%, 90.6%, and 72.5%… all on holding periods of a few days at most.

When bitcoin was down in the $98,700 range on temporary, bad news, I initiated a 20x leveraged long position in the granddaddy of crypto from which I will not look to exit until BTC is above $200,000—which would mark a gain of more than $5,000 on a $255 starting position.

All because I’m always looking for ways to exploit to my benefit the market’s in-the-moment emotions, which are almost always wrong.

So when you see the financial markets throw you lemons, don’t react. Think: Does this make any sense? Does this truly change the narrative? Or it is just a momentary blip?

Most of the time the reactions in the financial markets are illogical. They’re just a reflection of the emotions driving investors toward inefficiency.

Use that inefficiency to buy more lemons.