And, so, the inevitable continues marching in its inevitable direction…

The dollar I am talking about, here, and its incredible shrinking importance in the world, according to data from the International Monetary Fund. You can see what the source of today’s missive is in this chart:

Since 1999, the year the euro emerged, the dollar has pretty much been on a slow roll downhill in terms of its position as a global reserve currency. Yes, the buck remains king of the hill, but at 59% of global reserves, its kingdom has shrunk to the smallest in a quarter century (going back pre-euro).

I’m not sharing this to take a swipe at the dollar. I share this only to underscore a big, broad, long-running trend that shows no signs of stopping.

That trend, it turns out, is highly important to you and me because, well, our lives are largely priced in dollars. Our stock market investments are in dollars. Our life insurance is in dollars. Our house (if you own one) is in dollars. And our paycheck/Social Security is in dollars (though, earlier this year, I asked my employer to pay me half in dollars, half in euros so that I could better manage my currency risks).

When your entire life is denominated in one currency, well that’s just one, ginormous Humpty Dumpty sitting tenuously on a shaky wall.

To be clear, my paycheck decision and the chart above are not meant to imply anything positive about the euro. The pan-European currency has consistently hovered at around 20% of global reserves for the duration of its existence.

What I am getting at, instead, is that central banks the world over have been methodically ditching the dollar to diversify their risks. And to my way of thinking, that fact posits a significant question: If currency diversification and reduced exposure to the dollar is good enough for the world’s central banks…shouldn’t it be a strategy on our radar, too?

The IMF calculates that 80% of the reason that the dollar has lost 12 percentage points of stature as a reserve currency so far this century is due to “exchange rate fluctuations.”

Translation: The dollar has weakened against world currencies, a not-unexpected manifestation of America’s attempt at “Death by Debt.” (The other 20% is central banks buying and selling the dollar to support their own currencies.)

Taking the long view, the IMF concluded, the dollar’s declining share of global reserves “indicates that central banks have indeed been shifting gradually away from the U.S. dollar.”

I’ve talked about this before, but the dollar’s value has largely been following America’s money supply—the supply of dollars in circulation. That has risen sharply in the last 20 years as Congress and presidents have relied on debt and money printing to address a string of crises or to buy votes with tax cuts and expensive programs.

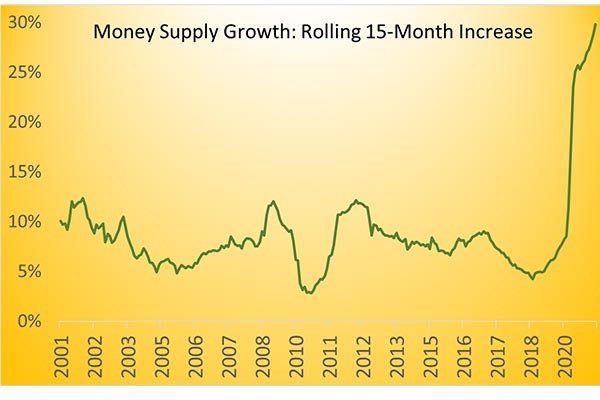

In the last 15 months alone—the COVID crisis—money supply is up nearly 29%. That doesn’t really mean anything, so let me show you what it looks like…

That’s the 15-month rolling increase in the supply of U.S. dollars. If ever you wanted a visual depiction of what a financial moonshot looks like, well that’s it. That’s the Federal Reserve’s promise of what former-Fed Chairman Ben Bernanke called “helicopter money”—just dumping dollars onto the landscape, helter-skelter.

This money-printing and Uncle Sam paying for his life with debt can go on for years more. It will go on for many more years, no question. And through it all, the dollar will remain the most important global reserve currency, even as its stature weakens.

But none of this is without repercussions.

The rest of the world obviously sees that America’s financial house is a crisis waiting to happen. So, they’re pursuing the prudent strategy: Dumping dollars over time to reduce their exposure to the fallout.

Which is why I write to you regularly about currencies, gold, and crypto.

Money always looks for safe havens. During a crisis, it’s the people who never expected the crisis to happen in the first place who are suddenly reacting to their own bad planning and racing for safety. Before a crisis, it’s people like me who are connecting the dots and asking, “How is this likely to end?”

Well, an ever-shrinking percentage of global reserves in the dollar tells you that at some point, the dollar is no longer the most important global reserve currency. It’s just math—plus the ramifications of extreme amounts of debt.

Frankly, I don’t know when that day comes. I don’t know if there is a big event that will precipitate the ultimate move away from the greenback, or if it’s just a slow burn into oblivion.

All I know is that day draws closer with every sunset.

I’ve made moves to protect my spending power and my wealth. I own exposure to foreign currencies (in the Global Intelligence Letter, I’ve recently written about two you should own). I own exposure to gold—physical gold I personally hold, as well as gold-mining stocks and a particular gold ETF in my retirement accounts. And I own deep exposure to crypto, primarily bitcoin and Ethereum, the two biggest, because of their increasing relevance to finance and the global economy.

You still have time to prepare for what’s coming. The dollar’s ultimate decline into “just another currency” won’t arrive overnight. But it will arrive. And when it does, it will have far-reaching impacts on our wealth and our financial lives.

So, be your own central bank. Slowly reduce your exposure to the dollar by stocking up on your own non-dollar reserves.