Why Non-Fungible Tokens Are the Future of Investing

“How you feelin’ right about now?” my friend asked sarcastically in a FaceTime chat last week, a Cheshire Cat grin beginning to creep across her blonde-framed face.

I knew what she was fishing for.

She wanted me to tell her how upset I was that cryptocurrencies have gone weak in the knees and that my “stupid little pictures were stupid.”

That’s her way of defining non-fungible tokens, or NFTs—“stupid little pictures.”

“Feeling fine, my dear,” I replied. “You?”

“Fine? I know your crypto thingies are getting killed.”

“Mmmm—yeah, crypto is down. But my blue chip NFTs are actually up, and I’m about to make a 1,000% gain on a Legendary NFT I just bought.”

She was incredulous.

She’s one of my friends who just doesn’t get NFTs…the unique, one-of-a-kind cryptocurrencies that represent everything from digital art to venture-capital investing.

To her, there’s no reason a cartoonish, digital picture should be worth more than about $5…if that.

To those who understand the space, however, there’s a very good reason many NFTs regular fetches thousands, tens of thousands, or even hundreds of thousands of dollars.

That reason: utility.

Lots of NFTs today have a purpose. They are tied to real businesses that offer real services to real customers. The NFTs are simply a way of owning a piece of that business.

That can be hard for people to grasp…I get that. But this is the world we’re moving into.

Right now, we’re at the end of the Web 2.0 era.

The first iteration of the internet was Web 1.0…the age of dial-up modems and Altavista and AOL Online. Web 2.0 has been dominated by big data companies, the likes of Google, Facebook, Amazon, and so on.

Now, we’re entering Web 3.0, or Web3…a new age of the internet based on crypto technology.

Crypto technology offers huge advantages over traditional tech because it’s decentralized.

The tiring giants of Web 2.0 like Facebook like to store all their information and processes in-house, so they can control them. This is massively expensive, and it poses technical challenges. (Remember the Facebook crash last year when Facebook, Instagram, and WhatsApp were all inaccessible for hours.)

With crypto technology, we can remake the same services…but decentralized. This means they are spread out across vast networks spanning the globe. This makes them highly resilient and resistant to hacking. Bitcoin, a decentralized currency controlled by no one, proved that this technology works.

Already, scores of Web3 companies are emerging.

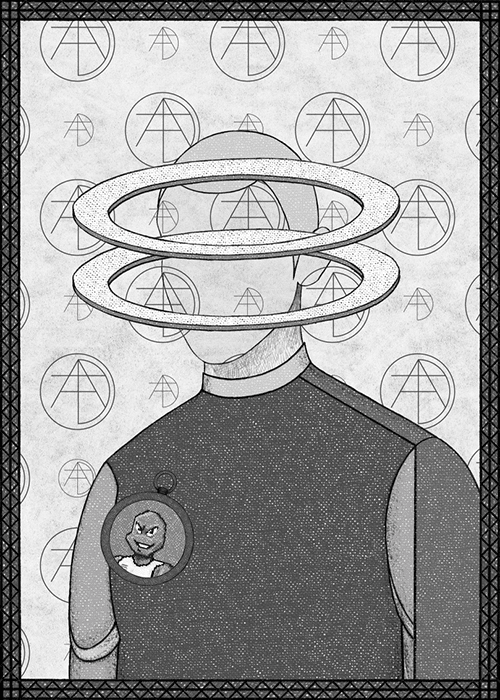

I own one called Atadia. It’s building what will become the Web3 version of Experian and TransUnion—a credit scoring service for a new-era internet in which online consumers hide behind avatars and profile pictures and don’t want to reveal their identity.

How do you offer credit in that world?

Atadia has come up with a solution for that. I won’t dive into those mechanics here, but I will tell you Atadia is built by a data scientist who worked for Harvard, the World Bank, and has taught securities regulators in the Thai government and Thai central bank how to use “big data” to ferret out fraud.

Credit scoring is worth multiple tens of billions of dollars globally. Atadia is an early mover in Web3 credit scoring and, I’m betting, will find American Express, Mastercard, Visa, and retailers knocking on its door as all of them move into Web3.

That’s what I mean by “utility.” Own an Atadia NFT, and you own a piece of that business.

It’s fundamentally no different that owning an Apple stock certificate—just a piece of paper with a picture on it and serial number recorded in a ledger, but which represents partial ownership of Apple.

An Atadia NFT is just a digital picture with a blockchain address recorded on an electronic register, but it represents partial ownership of the business.

That’s the primary reason I’ve been moving ever more deeply into NFTs and away from stocks.

Certain sectors aside—primarily commodities and consumer basics—much of the stock market is at risk today. But NFTs are so new, and the market is so immature, that it’s a fantastic place to be an investor.

It really is the Wild West in the best possible way. Everywhere you turn, a new opportunity (and a new risk, for sure) is emerging.

Which gets back to what will be a 1,000% gain.

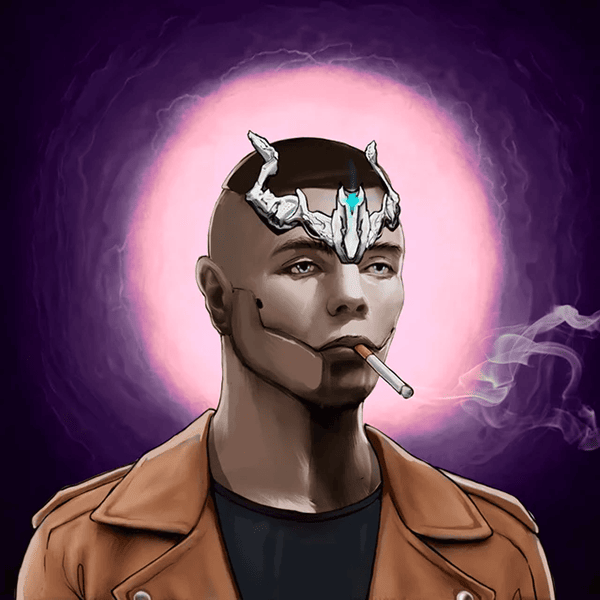

Late last week, I minted this:

That’s from an NFT project called The Bridged. It’s the second collection from one of the most popular NFT projects to appear in the last seven or eight months—SOLgods. This one ranks as “Legendary,” basically a 5 on a scale that runs to 6.

On the secondary market, Rares are selling in the 20 Solana range (Solana is one of the most popular cryptocurrencies for NFT trading). Legendaries are selling in the 30s. And Mythics, the top end, are 40 and above.

I’ve listed my Legendary at 33.33, and I’m confident it will sell at that price because of demand for this project.

Thing is, I minted this one for 3 Solana, or about $150 at the time. (“Minting” is when you buy an NFT at launch.) A sale of 33.33 would imply an 11x gain, or turning that $150 outlay into nearly $1,670. And if Solana, which is down at the moment, bounces back to its normal range near $100, the Solana I collect in this sale will be worth more than $3,300.

So, yes, my dear friend, I am doing fine.

Cryptos are down, but they will shoot back up. They are the future. No denying that fact when governments and businesses are all moving toward crypto in some fashion.

And while they’re down, I’m still locking in gains over hours, days, or weeks that most stock investors don’t see in years.